Copyright © 2023 Smee & Ford

The value of charitable estates also saw a significant increase, from £19.9bn in 2021 to £21.bn in 2022 – a 7% growth and the first time values have exceeded £20bn.

Estate value growth is important to legacies because growth in estate values translates to growth in the values of residual bequests. In recent years, we have seen growth in the average value of charitable estates, from £496k in 2017 to £576k in 2022. Over the past year, the average value of a charitable estate has increased by 8%.

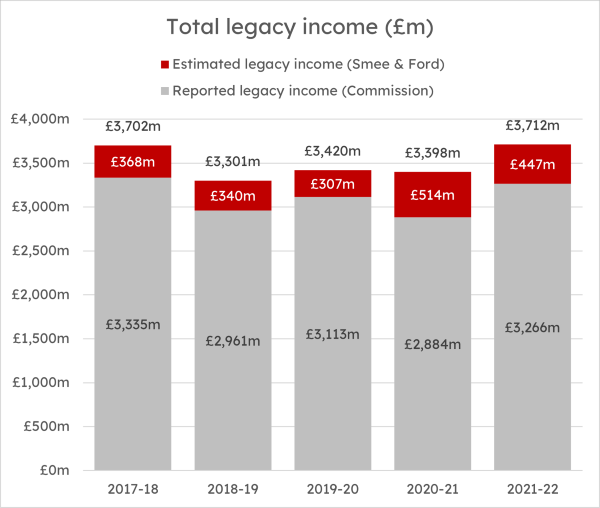

It is encouraging to see total legacy income for charities reach a record high in 2022, as well as a new milestone reached for the value of charitable estates. We hope that legacies will remain resilient in the face of the current economic climate, and remain committed to supporting the sector with valuable market insight throughout this year and beyond.